Here we celebrate a document that was once a commonplace part of daily life for millions – the humble cheque, now consigned to history in today’s cashless automated payment systems. Many of today's young people have never experienced the joy of writing or receiving a cheque.

A cheque (or check in the United States), is a negotiable instrument instructing a financial institution to pay a specific amount of a specific currency from a specified transactional account with that institution. It is the document that records the order to a bank to pay a specific amount of money from a person's account (often called a current, cheque or checking account) to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, would write the various details including the monetary amount, date, and a payee on the cheque, and sign it, ordering their bank, known as the drawee, to pay that person or company the amount of money stated; if there were insufficient funds in the drawer’s account, the cheque was said to have ‘bounced.’

The spellings check and cheque were used interchangeably from the seventeenth century until the twentieth century. ‘Check’ is the original spelling, said to derive from ‘a check against forgery’. The spelling ‘cheque’, is believed to have come into use around 1828, when the term was used by James William Gilbart in his Practical Treatise on Banking.

The origin of the cheque

The cheque had its origins in the ancient banking system, in which bankers would issue orders at the request of their customers, to pay money to identified payees. Such an order was referred to as a bill of exchange. The use of bills of exchange facilitated trade by eliminating the need for merchants to carry large quantities of currency (for example, gold) to purchase goods and services. Paper money evolved from promissory notes, another form of negotiable instrument similar to cheques in that they were originally a written order to pay the given amount to whoever had it in their possession (the "bearer").

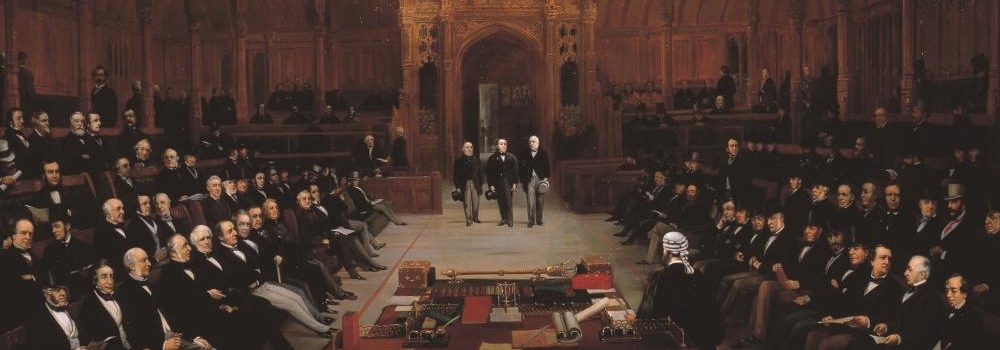

Forms of cheques have been in use since at least the ninth century. During the Maurya Empire in India (321 to 185 BC), a commercial instrument called the ‘adesha’ was in use, which was an order on a banker desiring him to pay the money of the note to a third person. The ancient Romans are believed to have used an early form of cheque known as ‘praescriptiones’. In the 13th century in Venice bills of exchange were developed to facilitate international trade; their use subsequently spread to other European countries. By the seventeenth century, handwritten ‘drawn notes’ (prototype cheques) were being used for domestic payments in England, because they enabled a customer to draw on the funds that he or she had in the account with a bank and required immediate payment. The earliest example known still to be in existence, dated 16 February 1659 was drawn on Messrs Morris and Clayton, scriveners and bankers in the City of London. In 1717, the Bank of England pioneered the first use of a pre-printed form, printed on "cheque paper" to prevent fraud, and customers had to attend in person and obtain a numbered form from the cashier. Once written, the cheque was brought back to the bank for settlement. Until about 1770, an informal exchange of cheques took place between London banks. Clerks of each bank visited all the other banks to exchange cheques, whilst keeping a tally of balances between them until they settled with each other. Daily cheque clearing began around 1770 when the bank clerks met at the Five Bells, a tavern in Lombard Street in the City of London, to exchange all their cheques in one place and settle the balances in cash. This was the first bankers' clearing house.

After the Second World War, as cheque processing became increasingly automated, millions of cheques were issued annually. The first cheque guarantee cards were introduced in 1969, allowing a retailer to confirm that a cheque would be honoured when used at a point of sale. The drawer would sign the cheque in front of the retailer, who would compare the signature to the signature on the card. Such cards were generally phased out and replaced by debit cards, starting in the mid-1990s, when cheque use peaked.

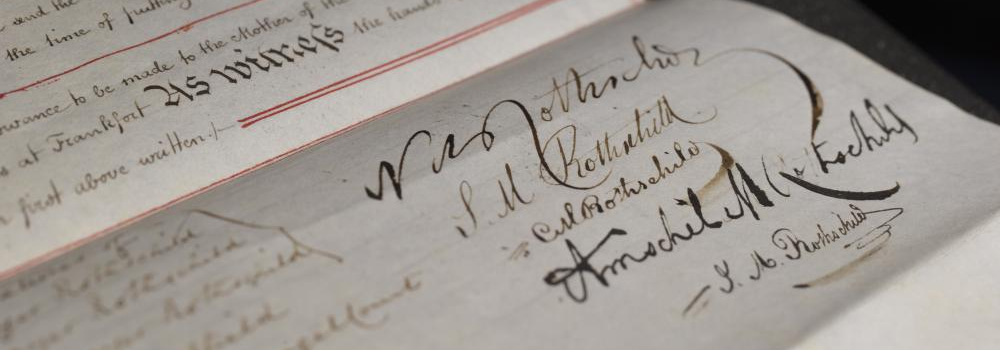

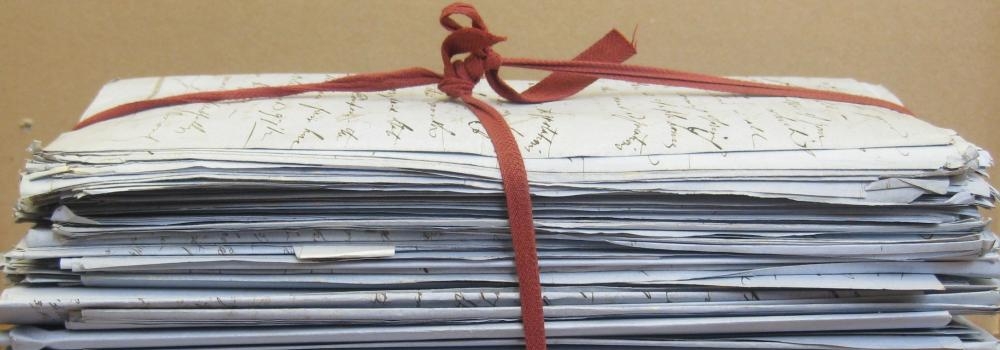

Cheques in the Archive collection

The Archive collection contains many examples of cheques drawn on the businesses of N M Rothschild & Sons and de Rothschild Frères. A selection of ‘ancient cheques’ was bundled up, probably at the time of the compilation of the Old Catalogue of the Archives in the 1920s. They illustrate the range of bank signatories and record the names of the bondholders of the earliest loans of N M Rothschild, such as the 1818 Prussian loan, 1822 Russian loan and 1822 Neapolitan loan. The earliest cheques are in the hand of Nathan Mayer Rothschild himself, but some cheques signed by his wife, Hannah, on his behalf have also survived. Also preserved in the collection is what is presumed to be the first cheque in the name of N M Rothschild & Sons, signed by Nathan’s son Lionel (1808-1879).

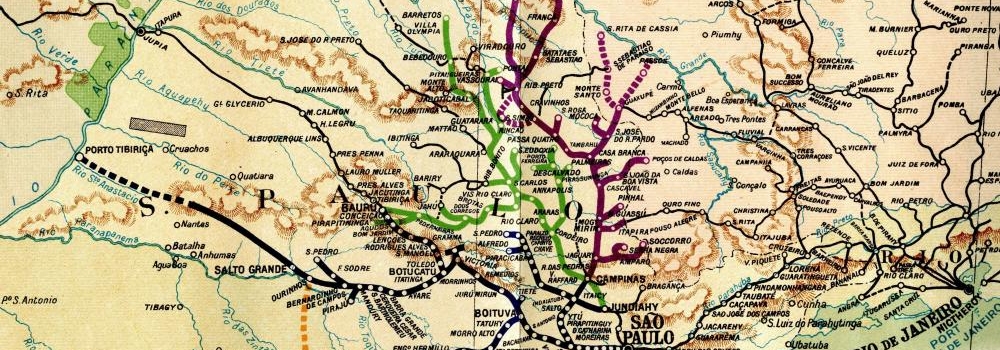

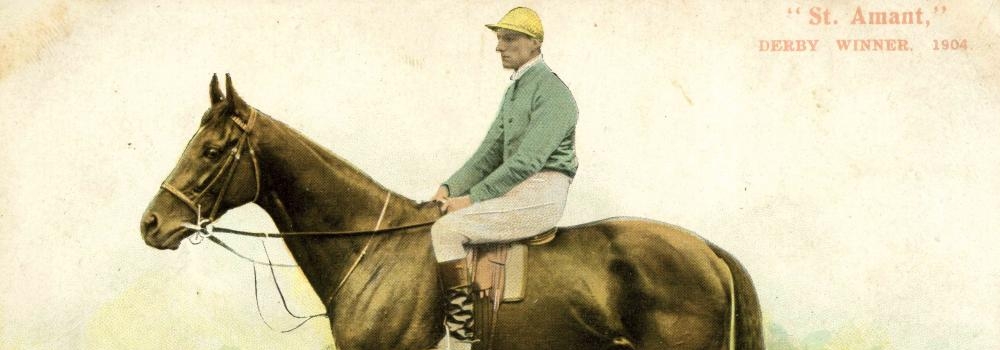

The collection also contains (on deposit from a private collection) a cheque drawn on de Rothschild Frères, 12 February 1871 for the payment of one million Prussian thalers from the account of the City of Paris to S. Bleichroder, Berlin, being an indemnity imposed upon the City of Paris following its capitulation on 28 January 1871 during the Franco-Prussian War.

The end of the cheque

The vast majority of retailers in the United Kingdom and many in Europe have not accepted cheques as a means of payment for over a decade, and cheque guarantee cards are no longer issued. Cheque usage has declined dramatically both for point of sale transactions (for which credit cards and debit cards are preferred) and for third party payments (for example bill payments), where the decline has been accelerated by the emergence of telephone banking and online banking. Being paper-based, cheques are costly for banks to process in comparison to electronic payments, and today many other methods of payment are available including Direct Debit, Wire Transfer such as Western Union and MoneyGram, ApplePay, PayPal, WorldPay to name but a few.

Cheques are now widely a thing of the past, or at most, a niche product used to pay private individuals or a dwindling number of small service providers. However, ‘symbolic cheques’ are still used at events to depict money awarded to payees, such as those given to lottery winners or charities.

Historic cheques have an appeal for collectors, as like stamps, cheques lend themselves well to be collected in various 'themes' such as issuing bank or geographical location. Prices range from just a few pence to several hundred pounds for the earliest varieties. Collectors of historic cheques may join the British Banking History Society (incorporating the British Cheque Collectors Society).

RAL VIII/62/1-23