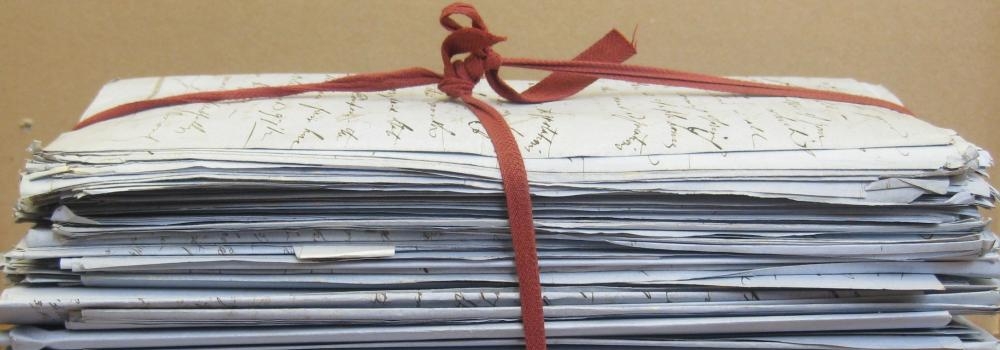

Basket of 19th century cancelled bond coupons and bonds issued by N M Rothschild & Sons in London.

The bond was an important financial instrument of the nineteenth century. A bond, enshrining the contract between borrower and banker, was a valuable document: its holders were entitled to present attached coupons at prescribed intervals to receive interest on their investment, and present the bond itself for return of the principal on maturity.

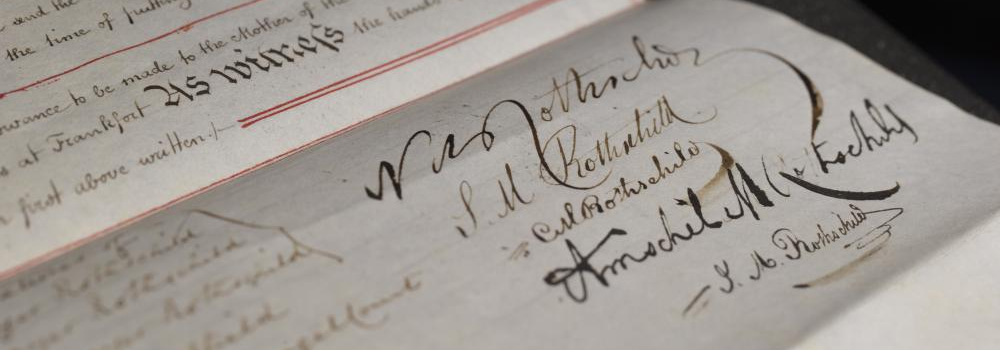

The first Rothschild bond issue, 1818

With the Rothschild bond issue for Prussia in 1818 as the model for a mutually acceptable contract between borrower and investor, the international market in bonds could be said to have truly begun. This bond made for the first time investing in governments overseas an attractive prospect for the individual. Loans could be denominated in sterling with dividends payable in sterling in London and other financial centres: by these means currency risks were greatly reduced, and with a sinking fund to repay the principal, the schedule for eventual repayment was made explicit to the investor.

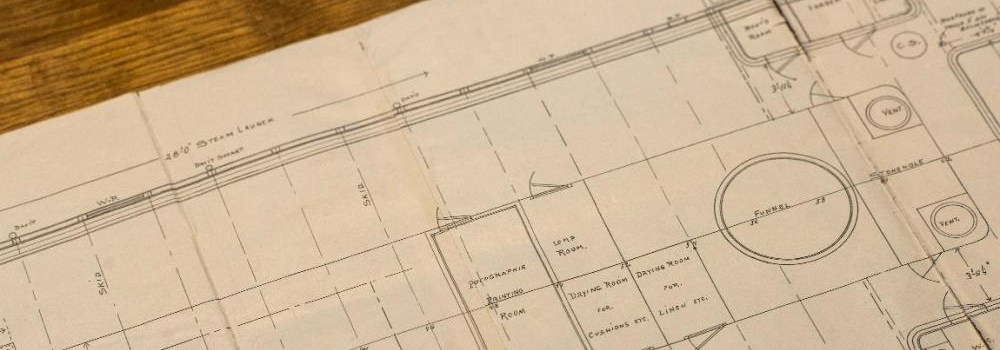

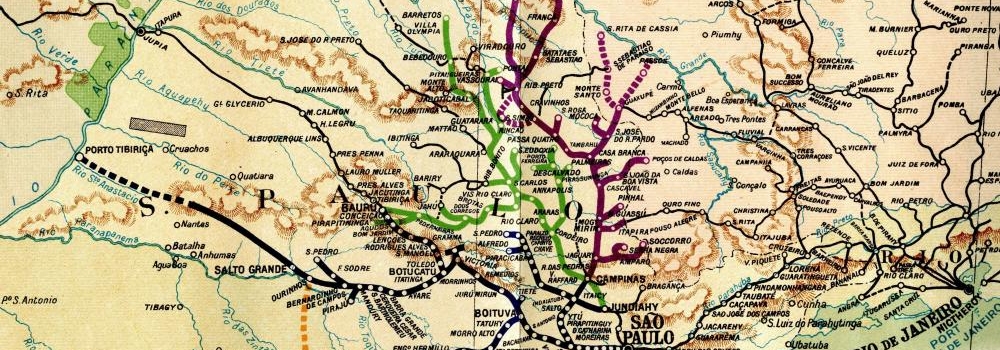

The Rothschild prominence in the London market in government bonds is impressive. It is estimated that between 1865 and 1914 almost three-quarters of this market was handled by N M Rothschild & Sons, either solely or in partnership, many for loans for infrastructure projects such as railways.