Origins of the Rothchild banking business

Mayer Amschel Rothschild (1744-1812) laid the foundations on which his five sons and their descendants would build a Europe wide banking empire.

With the help of relatives, Mayer Amschel secured an apprenticeship under Jacob Wolf Oppenheimer, at the banking firm of Simon Wolf Oppenheimer in Hannover, in 1757, where he acquired useful knowledge in foreign trade and currency exchange, before returning to his brothers' business in Frankfurt in 1763. He became a dealer in rare coins and won the patronage of the immensely wealthy Crown Prince Wilhelm I of Hesse (1743-1821), who had also earlier patronised his father. His coin business grew to include a number of princely patrons, and then expanded through the provision of financial services. In 1769, Mayer Amschel gained the title of 'Court Agent', managing the finances of Wilhelm I who became Wilhelm IX, Landgrave of Hesse-Kassel on the death of his father in 1785. Business expanded rapidly following the French Revolution when Rothschild handled payments from Britain for the hire of Hessian mercenaries.

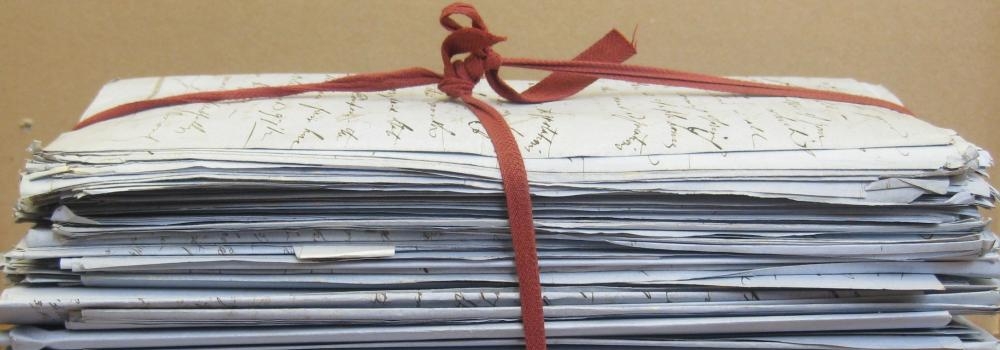

In 1806, Napoleon invaded Hesse in response to Wilhelm IX's support for Prussia. On the advance of Napoleon's army, Wilhelm IX was forced to go into exile in the Duchy of Holstein. The dilemma of how to conceal his coffers from the occupying forces was solved by Carl Friedrich Buderus (1759-1819), his financial adviser, who recommended that all his stock be confided to the House of Rothschild because they were best placed to protect his funds, and he thus entrusted part of his vast fortune to Mayer Amschel Rothschild for safekeeping. Mayer turned to his son, Nathan, in London. Nathan invested £550,000 of Wilhelm IX's funds in British government securities and bullion. These investments proved extremely lucrative and, by the time Wilhelm IX returned from exile, had accrued considerable interest. The Rothschilds' reputation for trustworthiness and astute financial management was firmly established.

From 1807, under Buderus' influence, Wilhelm IX's extensive financial transactions were largely exclusively handled by the House Rothschild, and until the expulsion of the French army from the Electorate of Hesse in 1813, Buderus, on behalf of Wilhelm IX, used the services of the Rothschilds to discreetly carry out financial transactions throughout Europe. In these early years of the 19th century, Mayer Amschel Rothschild consolidated his position as principal international banker to Wilhelm IX and began to issue his own international loans, borrowing capital from the Landgrave. He also profited from importing goods in circumvention of Napoleon's continental blockade. As a result of these dealings, Mayer Amschel amassed a not inconsiderable fortune

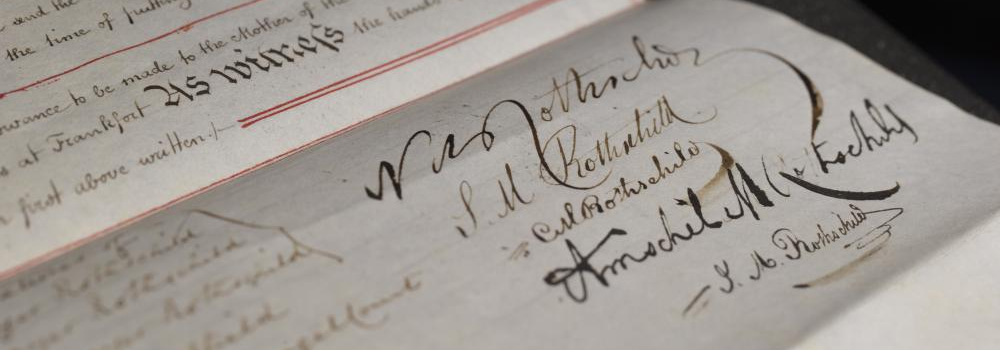

The first Rothschild Partnership

In 1810, Mayer Amschel renamed his firm M A Rothschild und Söhne, establishing a partnership with his four sons still in Frankfurt, (his son Nathan Mayer Rothschild (1777-1836) had arrived in England in 1798, establishing a business in Manchester, before moving to London to found N M Rothschild in the City in 1809). Read more about the First Rothschild Partnership Agreement here »

The five sons of Mayer Amschel Rothschild

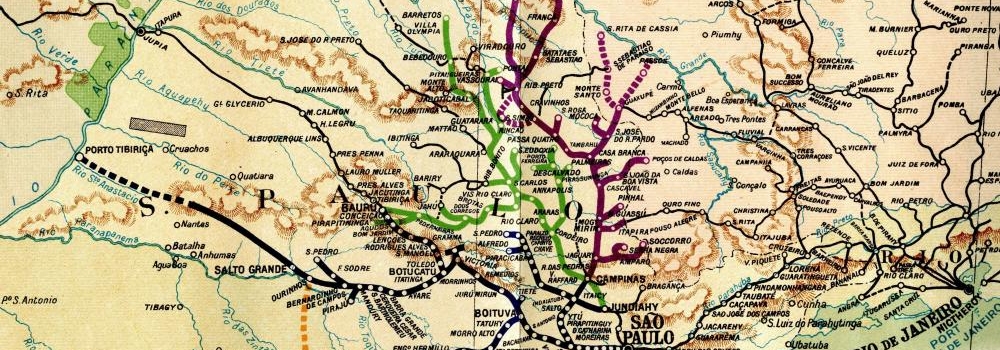

Nathan Mayer Rothschild’s increasingly successful business provided a model for his brothers back in Frankfurt. In 1812, James Mayer Rothschild (1792-1868) established a banking house in Paris. Salomon Mayer Rothschild (1774-1855) settled in Vienna in 1820. Carl Mayer Rothschild (1788-1855) set up business in Naples in 1821, leaving Amschel Mayer (1773-1855), to head the Frankfurt bank. From these roots, the Rothschild banking business spread out across much of Europe becoming the most successful international bankers of the age. The core banking business is today in the hands of the seventh generation of Rothschilds. Click on the nlinks tothe left to read more bout the history of the Rothschild businesses in Frankfurt, London, Paris, Vienna and Naples.